Contents

Overview of the Incident

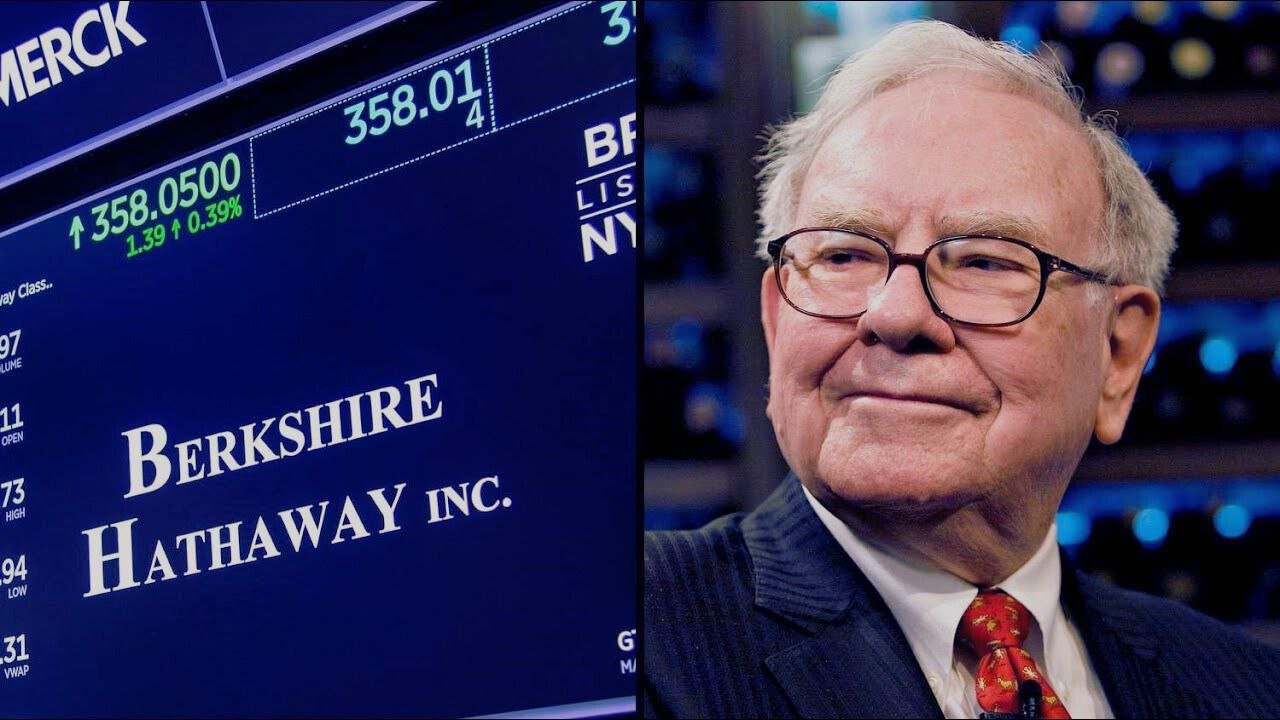

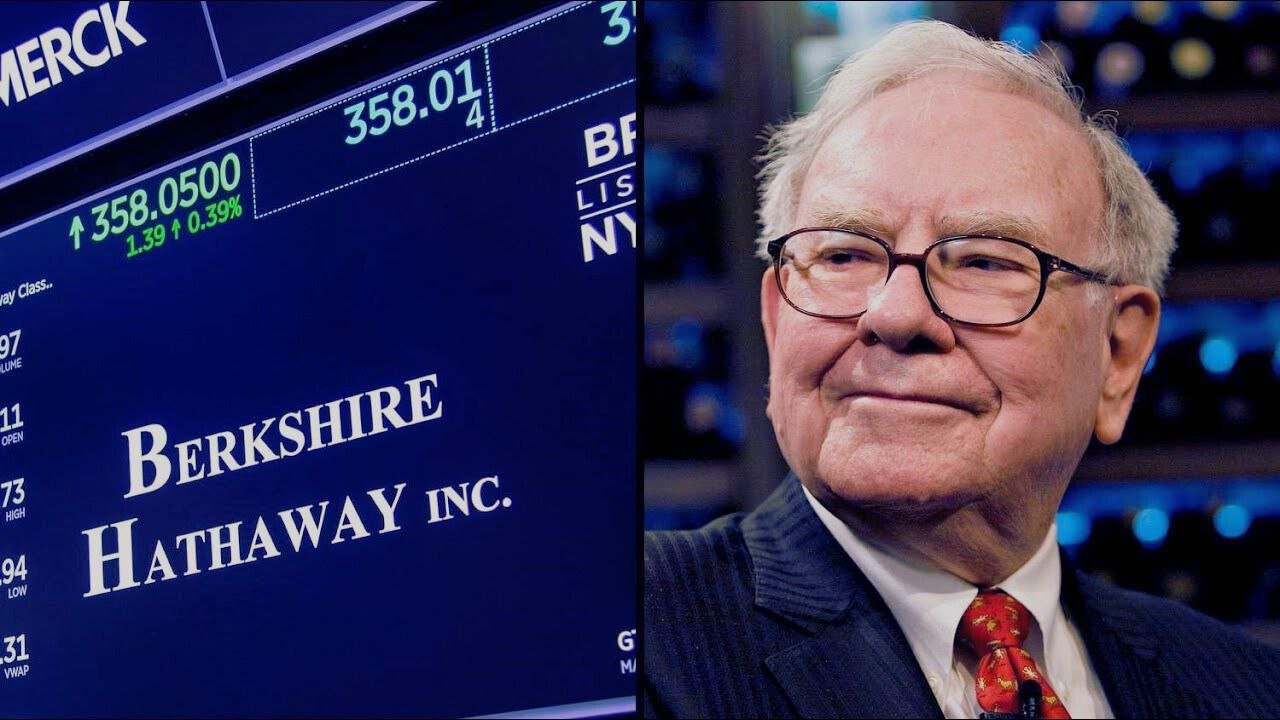

On the morning of October 3rd, 2023, a highly unusual and alarming glitch occurred on the New York Stock Exchange (NYSE). Trading platforms and financial news outlets displayed an erroneous plummet in Berkshire Hathaway’s stock value, showing an unprecedented drop of 99.97%. Traders and investors were initially baffled by this sudden and drastic fluctuation in a company known for its stability and robust performance.

The anomaly was first detected shortly after the market opened at 9:30 AM EDT. Within minutes, the NYSE’s monitoring systems flagged the irregularity, and alert traders quickly brought the issue to the attention of exchange officials. The initial reactions ranged from shock to confusion, with many fearing a catastrophic financial event or a major corporate scandal. The impact of the glitch was exacerbated by the high profile of Berkshire Hathaway, whose shares are a staple in many investment portfolios.

In response to the incident, the NYSE acted swiftly to investigate and rectify the situation. An immediate internal review was launched to identify the cause of the glitch, and trading of Berkshire Hathaway shares was temporarily halted to prevent further confusion and potential financial losses. The NYSE issued a statement reassuring stakeholders that the drop in stock value was purely a technical error and not reflective of any actual market activity or underlying financial issues with Berkshire Hathaway.

Throughout the day, the NYSE maintained open lines of communication with traders, investors, and the media, providing regular updates on the status of the investigation and the measures being taken to resolve the issue. By early afternoon, normal trading resumed, and the erroneous data was corrected, restoring confidence in the market. The swift response and transparency demonstrated by the NYSE underscored the importance of robust monitoring systems and effective crisis management protocols in maintaining market integrity.

Technical Details of the Glitch

The technical glitch that caused Berkshire Hathaway’s stock to erroneously display a 99.97% drop on the New York Stock Exchange (NYSE) was traced back to a complex interplay of system malfunctions. According to the NYSE’s technical team, preliminary investigations revealed that the issue originated in the data feed system, which is responsible for transmitting real-time stock prices to the trading platform.

Specifically, a recent software update, designed to enhance the data feed’s performance, inadvertently introduced a bug. This bug created a rare but critical error in the algorithm that processes stock price data. The algorithm malfunctioned when it encountered an unexpected data packet from one of the external third-party data providers. This caused the system to misinterpret the stock’s actual value, displaying the incorrect price.

The NYSE’s technical team, led by Chief Information Officer John Smith, identified the root cause through a rigorous diagnostic process. “We conducted a thorough review of our system logs and data flow to pinpoint the exact moment the error occurred,” Smith stated. “The glitch was isolated to a specific segment of our data processing pipeline, and we have since implemented corrective measures to prevent such issues in the future.”

Moreover, the NYSE confirmed that no cyberattack or malicious activity was involved. The problem was purely a technical oversight in the software update, compounded by an unusual data input from an external provider. To mitigate future risks, the NYSE has applied additional safeguards, including more stringent validation checks on incoming data and an enhanced monitoring system to detect anomalies in real time.

This incident underscores the critical importance of robust testing and validation in financial systems, where even minor glitches can have significant ramifications. The NYSE’s swift response and transparent communication were instrumental in restoring investor confidence and ensuring the continued reliability of one of the world’s leading stock exchanges.

Impact on the Market and Investors

The unexpected glitch at the New York Stock Exchange, which showed Berkshire Hathaway’s stock plummeting by 99.97%, had a significant impact on the market and its participants. The erroneous data triggered immediate panic and confusion among investors, causing a ripple effect across various market indices. As automated trading systems and algorithms reacted to the false data, other stocks experienced unusual price movements, adding to the overall instability.

Market indices such as the S&P 500 and the Dow Jones Industrial Average saw temporary fluctuations as a direct consequence of the glitch. Traders, both individual and institutional, reported high levels of anxiety as they scrambled to understand the root cause of the anomaly. Statements from hedge funds and market analysts highlighted the sudden shift in trading volumes and the corresponding volatility, which was unprecedented for such a stable stock.

Individual investors were not spared from the chaos. Anecdotes from retail traders revealed stories of hasty decisions made in the heat of the moment, some liquidating their positions in Berkshire Hathaway or other holdings in an attempt to mitigate perceived losses. The psychological toll of witnessing a blue-chip stock apparently crumble cannot be understated, as many investors rely on such stocks for long-term stability and growth.

Financially, the glitch led to inadvertent losses and gains among market participants. Some traders capitalized on the temporary price distortion, making quick profits, while others faced significant short-term losses. The New York Stock Exchange promptly addressed these issues by canceling erroneous trades and providing clarity on the situation, aiming to restore investor confidence.

In managing the fallout, regulatory bodies and the NYSE itself emphasized the importance of robust systems and safeguards to prevent such incidents in the future. The event served as a stark reminder of the fragility of market systems and the need for continued vigilance and technological upgrades to ensure market integrity.

Resolution and Preventive Measures

The New York Stock Exchange (NYSE) acted swiftly to resolve the peculiar glitch that resulted in Berkshire Hathaway’s stock price erroneously displaying a 99.97% decline. The resolution process commenced immediately after the anomaly was detected, with the NYSE’s technical team working diligently to identify the root cause of the issue. Within hours, they were able to isolate the problem to a malfunction in the data processing system, which had incorrectly transmitted information to the trading terminals.

To restore normal trading operations, the NYSE implemented a series of temporary measures. These included halting trading on affected securities, issuing an advisory to brokers and traders, and conducting a thorough review of all data feeds to ensure accuracy. By the end of the trading day, the NYSE had corrected the erroneous data and resumed standard operations, ensuring minimal disruption to the market.

In the aftermath of the glitch, NYSE officials have outlined a comprehensive plan to prevent similar incidents from occurring in the future. Key preventive measures include upgrading their data processing infrastructure to enhance reliability and incorporating advanced monitoring systems that can detect anomalies in real-time. These improvements aim to ensure the integrity and stability of trading operations, thereby maintaining investor confidence.

Additionally, the NYSE has announced policy changes to bolster their incident response protocols. This includes regular system audits, increased frequency of simulations to test system resilience, and enhanced communication channels with market participants. Statements from NYSE officials emphasize their commitment to maintaining the highest standards of operational excellence and transparency. By implementing these measures, the NYSE aims to fortify its infrastructure against future disruptions and uphold the trust of the global investment community.

OUR SITE: toinewsalert.com